PERSPECTIVES

MARKET AND ALLOCATION

Our experts monthly overview

OUR CENTRAL SCENARIO

Deputy Chief Executive Officer,

Chief Investment Officer

OFI INVEST

The planet’s major central banks confirmed at their annual Jackson Hole meeting that their fight against inflation was not over. But two factors did change. The first of these was the degree of urgency - interest rates are now in restrictive territory and core inflation has stabilised in Europe and begun to recede in the United States. Second, central banks are becoming more dependent than ever on inflation data (in Europe in particular), as well as on data on jobs and wages in the US, where inflation will inevitably recede with the easing in wage pressures. The scenario of an orderly landing is gaining ground, and pressure on the long section of the yield curves is therefore likely to ease by yearend. Against this backdrop, the ECB and the Fed are now likely to raise their key rates just one more time, at most, before keeping them level for several quarters, while keeping an eye on a resurgence in inflation. Yield curves are now pricing in this scenario, and we are accordingly sticking to our long-dated rate targets of 2.50%, 3.00% and 3.75%, respectively, in Germany, France and United States on 10-year paper in the coming months.

This scenario backs our bullish stance on corporate bonds, in particular the highest rated high yield, on which the carry trade is likely to continue remunerating the risk incurred. Moreover, offsetting mechanisms between interest rates and credit spreads are still in action, thus ensuring that the asset class will be less volatile during periods of stress.

Bad news from China and lack of clarity on central banks’ attitudes towards inflation caused a dip in equity indices in August. This reflected the markets’ concerns regarding anti-inflation measures’ impacts on both interest rates and growth. The slowdown expected in various economies as interest rate concerns ease is expected to create phases of volatility that will be opportunities for repositioning on the equity markets in the coming months. In light of this, we are sticking to our approach of slight tactical caution on risky assets.

OUR VIEWS AS OF 05/09/2023

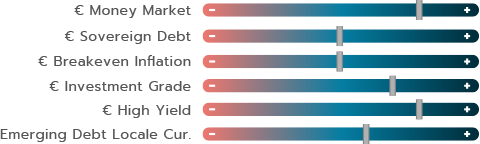

The scenario of a long plateau for key rates is taking shape. US and European central banks are readying a pause in their tightening cycle while keeping a close eye on prices. This phase, with perhaps one last rate hike, could last several months. This outlook for a long pause is anchoring rate expectations at attractive levels and is providing a boost to the bond markets. Accordingly, we reiterate our positive view on this asset class. On 10-year German and US yields, there seems to be little upside and little downside. We therefore believe that bonds are worth having for the carry trade. We are accordingly sticking to our preference for money-market investments and for high-yield corporate bonds. Investment grade is also worth having, in our view, in particular the 2y-3y section. And, lastly, emerging market debt is still attractive, as most national central banks are in a monetary easing phase.

Equity markets remain very resilient on the whole. They continue to be driven by prospects for a US soft landing. Recession scenarios have almost completely vanished from economists’ radar for 2023. And yet, it is hard for us to see how the more hawkish monetary policies on both sides of the Atlantic will have no impact at all on economic activity. Accordingly, we reiterate our cautious take on the outlook for margins and earnings growth in the second half of 2023, as well as 2024. The main driver of equity reratings could therefore be missing in the coming quarters.

Despite the BoJ’s shift in its yield curve control policy, which widened the flexibility on its 10-year yield tolerance, the yen gave up ground. We are keeping our exposure to the yen because of its gap with its fundamental value and because an additional adjustment in monetary policy could occur in the coming quarters. The euro could continue to fluctuate with in a range around 1.10 vs. the dollar, based on our anticipations regarding the Fed and the ECB, and we are sticking to our neutral stance.

MACROECONOMIC VIEW

A MULTI-TRACK SUMMER

Head of Macroeconomic Research

and Strategy

OFI INVEST ASSET MANAGEMENT

Global growth will probably beat expectations this year, while remaining slightly below 3%, but the real surprises are in its geographical breakdown. US economic activity remains surprisingly resilient and has managed to offset disappointing growth in China and stagnation in Europe. Regarding prices, the receding in inflation has been in line with initial forecasts, thanks first to favourable energy base effects and second to more moderate goods inflation following the normalisation of supply chains. For the rest of the year, food inflation is likely to continue receding, along with other, less volatile components, but to a lesser extent. With this in mind, core inflation is likely to remain above total inflation for the rest of the year in both the US and the euro zone.

THE US REMAINS SURPRISINGLY RESILIENT

All US data are good news for those who share the US Federal Reserve’s view of an unprecedented scenario in which disinflation occurs without a recession. The job market is easing without collateral damage, as the imbalance between labour supply and demand is gradually absorbed. We have moved from a peak of 2.0 job offers per unemployed person to 1.5.

The US unemployment rate rose slightly in August, from 3.5% to 3.8%, driven up by a higher participation rate but it remains historically low. Job data have reassured the Federal Reserve and its chairman, Jerome Powell, whose tone was balanced at the Jackson Hole seminar in late August between the risks “of doing too much or not enough”, thus suggesting that interest rates will remain at 5.5% at the coming meetings.

We reiterate our cautious take on what comes next, from the point of view of both business investment (hit by monetary tightening and unresolved regional bank issues) and consumption, as the current pace of household spending (with the savings rate once again under 4%) is unsustainable in a context in which employment is likely to continue slowing.

THE EURO ZONE CONTINUES TO AVERT A RECESSION

While a recession has been officially averted in the euro zone, we don’t think that second quarter’s 0.3% growth is sustainable, as it was driven by one-off factors such as Irish growth and France’s exceptionally strong exports, due to the delivery of a large cruise ship. Data available for the current quarter back our point of view, as they continue to point to economic activity that is sluggish and in a slowing phase.

The manufacturing recession is gradually deepening, dragging services down behind it. Moreover, the dispersion of growth between countries is broadening, with Spain and France outperforming Germany and Italy, which have been hit harder by the aftermath of the energy crisis and, more recently, by weakness in the Chinese economy. The ECB’s latest quarterly survey of banking establishments revealed a decline in demand for loans from economic actors (that was especially spectacular in the case of companies) and a toughening in lending criteria. Naturally, the effects of monetary tightening will be uneven, with real estate among those sectors suffering the most. Real-estate financing costs are likely to rise for several more quarters, dragging prices down, in turn, although we see little risk of forced selling.

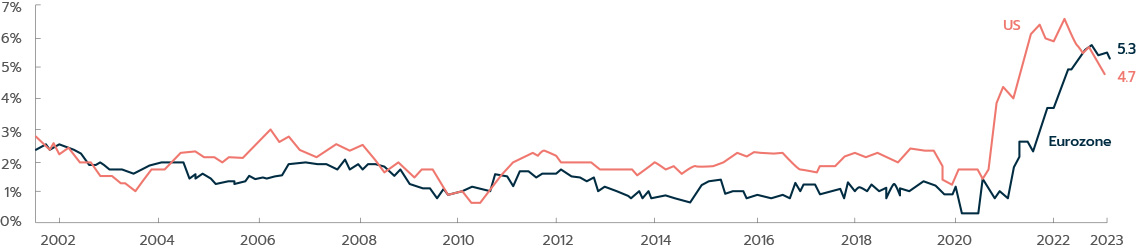

What about the ECB? Key rate hikes appear to be approaching their end, even in Europe, but the possibility of one last rate hike will be discussed at the September meeting. The reasons for this are that signs of moderation in core and services inflation are less evident than in the US (see chart) and that wages are still catching up. We believe this would be the last rate hike, and that the ECB, like the Fed, would stay on a high plateau for some time to come, while remaining alert to inflation as its priority.

INTEREST RATES

BOND MARKETS ARE STILL RIDING HIGH

Co-CIO, Mutual Funds

OFI INVEST ASSET MANAGEMENT

The main European bond indices ultimately ended the month of August in positive territory despite a slight resurgence of volatility in rates. The highlight of the month came from the US, with the 10-year yield accelerating to 4.34% on 21 August before pulling back to 4.10% at month-end. Against all expectations, this exceeded the spike of 2022, reaching a level unprecedented since 2007. It was driven mainly by upward revisions in US growth forecasts against a backdrop of the thinner liquidity that often occurs in summer.

THE NORMALISATION OF MONETARY POLICY IS WELL UNDER WAY

On the central bank front, there was little change to market expectations after the Fed’s and ECB’s 25 basis point hikes in late July. While a status quo is possible at the September meetings, all options are still on the table.

Bottom line: terminal rates now appear to have been reached, give or take one last rate hike. Expectations of rate cuts in 2024 have receded, confirming our scenario of a long plateau for key rates. The first inflation figures for August point towards a stabilisation at 5.3% in Europe. However, the disinflationary trend, slowed by resilience in services, is likely to continue in the coming months.

Despite upward revisions on the US economy, macroeconomic momentum continues to worsen in other major economies, particularly in Europe and China. The Fed chairman, Jerome Powell, did recall, during his Jackson Hole speech, that not all effects of monetary tightening on the real economy had shown up yet. And lastly, while monetary policy is well on the way to normalising, normalisation of fiscal policies will be an issue of discussion in the coming months. So, visibility on the rest of the year looks limited and, accordingly, we are keeping a long-duration bias in the 2.40% region on 10-yield German yields.

MONEY-MARKET AND CORPORATE BONDS LEADING THE WAY

The soft landing scenario should provide a boost to fixed-income assets in Europe. While US markets have increasingly priced in a Goldilocks scenario this summer, coming releases of leading indicators will be especially important to keep an eye on, particularly in the services sector.

In the event of a downward revision, a more cautious market stance is unlikely to cause a significant widening in spreads, on either the government or corporate bond markets.

Our preference is for money-market investments, which are unbeatable in terms of risk/reward, with yields close to 4%, but corporate bonds are not far behind them, with high yield in particular currently trading at about 8%.

Regarding fundamentals, corporate releases are still solid, and guidance is reassuring. Moreover, defaults are unlikely to rise significantly in the coming months. In this asset class, current spreads price in default rates of 8.0%, vs. 3.8% forecast by rating agencies. Although we are keeping a close eye on the real-estate sector, particularly in Nordic countries, we believe that the risks are likely to remain under control in the short and medium terms. The health of the banking sector is rather reassuring from this point of view. High yield’s average yield is especially attractive for its carry and may offer protection against possible increases in interest rates or spreads. A widening of 260 basis points would be needed on the asset class to erase this yield over one year – and, as things now stand, we don’t see that happening.

The yield of euro high yield corporate bonds (based on the Bloomberg Barclays Euro High Yield index as of the end of August 2023)

| BOND INDICES WITH COUPONS REINVESTED | AUGUST 2023 | YTD |

|---|---|---|

| JPM Emu | 0.29% | 2.60% |

| Bloomberg Barclays Euro Aggregate Corp | 0.16% | 3.42% |

| Bloomberg Barclays Pan European High Yield in euro | 0.32% | 6.45% |

Past performances are not a reliable indicator of future performances.

EQUITIES

RESILIENCE BUT PRUDENCE

Co-CIO, Mutual Funds

OFI INVEST ASSET MANAGEMENT

Equity markets ultimately consolidated only superficially in August. Although the start of the month was a little shakier, due to an acceleration in inflation fears, particularly in the US and Europe, recent US jobs reports and inflation figures have eased those fears. Could the Goldilocks scenario – featuring a more hawkish monetary policy, lower end-prices, and a lack of a recession – actually be happening? The equity markets do seem inclined to grant it the benefit of the doubt, based on the latest economic releases. The only downside is China, where the lack of acceleration is once again penalising the Shanghai market.

A SOFT LANDING INCREASINGLY LIKELY IN THE US

Once again, investors continued to focus on US economic figures. And, to say the least, they were not disappointed! The month had hardly begun when the ADP jobs report found that twice as many jobs had been created then expected by the consensus, sending 10-year US yields above 4.3%, and causing a swoon in the Nasdaq and its highly rated stocks.

The release of US consumer price figures in mid-month allowed the markets to catch their breath as individual components continued to show more moderate price increases. Moreover, this soft landing in inflation was occurring in a unique context. True, the Fed had begun to pump the brakes on the economy over the previous 18 months by unleashing a cycle of more expensive credit, but the federal government continued to push (hard) on the accelerator, with a fiscal deficit of 8.5%, unheard of during an economic expansion! A soft landing in such conditions therefore constitutes a feat that the Fed seems to be bringing about.

KEEP AN EYE ON THE US CONSUMER

And yet, hiding behind these encouraging figures is a double reality. While figures on US consumer spending (two thirds of GDP) look as robust as ever, things are looking tougher for the most modest households, especially as prices have risen steeply over the past year. This pressure on needier consumers is also seen in their increased use of revolving credit facilities, now that they have used up most of their excess savings. Meanwhile, payment defaults are accelerating. And US banks, meanwhile, to toughen their credit conditions. The next consumer spending figures will therefore be key in assessing the extent of the current slowdown.

AND REAL ESTATE CHINOIS

China’s economy has stopped accelerating and its real-estate sector has continued to collapse. After Evergrande*, trading in whose shares resumed with an 85% plunge, it’s the turn of Country Garden*, a developer that is on the verge of defaulting. For the moment, the government is offering only minor monetary adjustments, which are unlikely in the short term to offer a truly adequate response to this burning issue. As a result, confidence indicators are falling, the unemployment rate is rising, and consumption is taken the brunt of it. Sino-US tensions aren’t helping matters. Naturally, foreign investors continue to head for the exits, despite already low valuations, and are switching to regions offering better visibility.

A GLUM EURO EQUITIES MARKETS

In the euro zone, the outlook is looking just as glum. Inflation is well anchored and is undermining household confidence. Manufacturing confidence is at a low, and recent surveys in services are showing the start of a downturn. Moreover, exposure to China is now seen as a drawback, based on the more cautious messages from some manufacturers. Accordingly, the markets appear to have little upside, although we still believe that manufacturing output may have bottomed out. Inventory drawdowns and normalisation of order books are likely to come to an end, which would allow small and mid-sized manufacturers to rally in the short term. This could give improve the outlook for some stocks, manufacturing and financial ones in particular.

The US mortgage rate in August, a 23-year high

| EQUITY INDICES WITH NET DIVIDENDS REINVESTED, IN LOCAL CURRENCIES | AUGUST 2023 | YTD |

|---|---|---|

| CAC 40 | -2.42% | 15.41% |

| EuroStoxx | -3.10% | 13.53% |

| S&P 500 in dollars | -1.65% | 18.33% |

| MSCI AC World in dollars | -2.79% | 14.80% |

Past performances are not a reliable indicator of future performances

EMERGING MARKETS

TWO MAJOR EMERGING MARKET EQUITIES CYCLES SINCE 2001

Chief Executive Officer

SYNCICAP ASSET MANAGEMENT

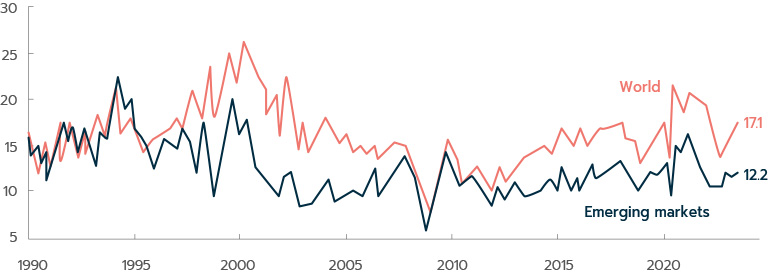

Emerging equities reflect the performances of companies located in regions whose economies are growing fast, due to their lower level of development. They are riskier but also offer greater potential, which should be priced in by the market. Such is not always the case. In a global economy, large US, European and Japanese companies have also benefitted by the development of emerging economies. Since the creation of the index, there have been two major cycles in emerging market equities.

The MSCI Emerging Markets index was created in January 2001. It encompasses 1422 stocks from 24 countries, the largest of which are China, Taiwan, India and Korea. Its companies’ market cap totals more than USD 7075bn, compared, for example, with USD 2300bn for the CAC 40. Since the creation of the index, emerging market equities have gone through two rather long and divergent cycles lasting almost 10 years.

Emerging market equities are currently viewed rather negatively by investors after disappointing performances over the past decade, with an annualised return of only about 1% in dollar terms since 2011. Keep in mind, however, that this followed a decade, the 2000s, during which emerging equities had by far outperformed, with an annualised return of almost 16% from 2001 to 2010.

So, during a first long cycle of almost 10 years, emerging market equities had met investors’ expectations. Simply put, this long period had three main features: China’s impressive boom after it joined the World Trade Organisation, an upward cycle in commodities, and a rather weak cycle in the dollar.

Since 2011, Western equities, US ones in particular, have outperformed by far, driven mainly by the impressive showing by US large-cap tech and Internet stocks. As a result, nine of the world’s top 10 market caps are US companies, eight of which are in the aforementioned sectors. Only Saudi Aramco* (the world’s third largest market cap) is not from the US. Equivalent Chinese stocks, which are also tech and Internet giants, have plunged over the past two years for various reasons, including regulatory measures in China (raising fears of prospects that they may be broken up), US sanctions, and general disfavour of the Chinese market.

The current cycle also features a relatively flat performance by all commodities, as well as something of a resurgence by the dollar vs. other main currencies, such as the euro, sterling and the yen, as well as emerging currencies.

For all these reasons, emerging market equities are currently trading at a discount, Chinese ones in particular (see chart). A discount is not a buying signal, of course, but it does provide some downside protection. Based on a reading of these two major historical cycles, this asset class could perform more favourably in the coming years. Commodities, particularly the metals needed for transitioning to a decarbonated economy, could see some gains. As for oil, underinvestment in recent years is likely to support prices, and the dollar now appears to be in somewhat elevated regions.

We believe that emerging market equities are currently rather attractive – for their rather low valuations in both absolute and relative terms and because they help raise a portfolio’s Sharpe ratio. We therefore believe this is the time, on a medium-term horizon, to allocate about 10% to market equities in an international portfolio.

The market cap of companies making up the MSCI Emerging Markets index, or almost three times more than the CAC 40

Past performances are not a reliable indicator of future performances.

Document completed on 05/09/2023

Carry: a strategy that consists in holding bonds in a portfolio, possibly even till maturity, in order to tap into their yields.

Core inflation: inflation ex energy and ex food.

Inflation: loss of purchasing power of money which results in a general and lasting increase in prices.

Investment Grade / High Yield credit: Investment Grade bonds refer to bonds issued by borrowers that have been rated highest by the rating agencies. Their ratings vary from AAA to BBB- under the rating systems applied by Standard & Poor’s and Fitch. Speculative High Yield bonds have lower credit ratings (from BB+ to D, according to Standard & Poor’s and Fitch) than Investment Grade bonds as their issuers are in poorer financial health based on research from the rating agencies. They are therefore regarded as riskier by the rating agencies and, accordingly, offer higher yields.

PER: Price to Earnings Ratio. A stock market analysis indicator: market capitalisation divided by net income.

Sharpe ratio: measures an investment portfolio’s risk-weighted performance.

Spread: difference between interest rates. Credit spread is the difference in interest rate between a corporate bond and a same-dated benchmark bond that is regarded as the least risky (benchmark government bond). Sovereign spread is the difference in interest rate between a sovereign bond and a same-dated benchmark bond that is regarded as the least risky (German benchmark government bond).

Volatility: a measure of the amplitudes of price variations of a financial asset. The higher the volatility, the riskier the investment is considered to be.

This promotional document contains information and quantified data that Ofi Invest Asset Management considers to be well-founded or accurate on the day on which they were produced. No guarantee is offered regarding the accuracy of information from public sources. The analyses presented are based on the assumptions and expectations of Ofi Invest Asset Management at the time of the writing of this document. It is possible that such assumptions and expectations may not be validated on the markets. They do not constitute a commitment to performance and are subject to change. This promotional document offers no assurance that the products or services presented and managed by Ofi Invest Asset Management will be suited to the investor’s financial standing, risk profile, experience or objectives, and Ofi Invest Asset Management makes no recommendation, advice, or offer to buy the financial products mentioned. Ofi Invest Asset Management may not be held liable for any damage or losses resulting from use of all or part of the items contained in this promotional document. Before investing in a mutual fund, all investors are strongly urged, without basing themselves exclusively on the information provided in this promotional document, to review their personal situation and the advantages and risks incurred, in order to determine the amount that is reasonable to invest. Photos: Shutterstock.com/Ofi Invest. FA23/0167/04032024.