PERSPECTIVES

MARKET AND ALLOCATION

Our experts monthly overview

OUR CENTRAL SCENARIO

Deputy Chief Executive Officer,

Chief Investment Officer

OFI INVEST

The latest news in Europe and the US reassured the markets on the trajectory of inflation. The markets (but not us) had been expecting one last hike in short-term rates, but yield curves are now pricing in initial rate cuts as early as the first quarter of 2024. It is no doubt too early for either the Fed or the ECB to lower their guard on core inflation. Yes, US growth is likely to slow and ease wage pressures, but we don’t see any rate cuts from the Fed until summer and probably one quarter after that from the ECB.

With that in mind, it is worth taking some profits after the robust bond rally, and we are therefore moving to a neutral stance on sovereign yields. They are likely to remain at moderate levels in the coming quarters, but there are already enough short-term rate cuts priced into the curve, we believe, to trigger a new rally (barring unforeseen geopolitical events). On the European debt front, the decision from Karlsruhe has shaken the German coalition in the run-up to European elections in June 2024. And with a dozen or so European countries (including France) likely to be under threat of an excessive deficit procedure from Brussels, volatility in European debt could be back in 2024.

Against this backdrop, we continue to overweight investment grade and high yield (BB in particular) within corporate bonds. Selectivity is the watchword, given the degree of companies’ refinancing needs.

Equities rallied, driven by the lifting of some uncertainties on the interest-rate front and the receding of geopolitical risk. The former driver looks well priced in and is unlikely to provide much more momentum. As for geopolitical risk, while the Middle East conflict appears to have peaked, tensions remain high, with attacks by pro- Iranian Houthis on commercial vessels in the Red Sea. And, lastly, corporate earnings forecasts for 2024 look too high and are likely to be revised downward in the coming months, given the weak global growth (2.5%) expected in 2024, and that would drive equity prices down. We therefore see little upside potential in the short term, and some profit-taking may be in order. New bouts of volatility are likely, and they will provide an opportunity for repositioning on risky assets.

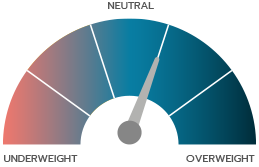

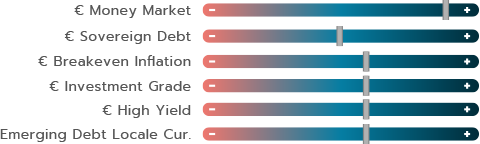

OUR VIEWS AS OF 06/12/2023

The government bond market shifted course in November with inflation figures lower than expected. This could confirm the end of the Fed’s and ECB’s tightening cycles. Inflation has tracked growth lower and made rate cuts more likely in 2024. The markets are pricing in a first possible cut as early as March, followed by four more during the year in Europe and the US. On the corporate bond markets, spreads are at a low on the year, but we believe they are still attractive compared to their longterm averages. That’s why we are once again neutral on sovereign bonds and continue to prefer investment grade and high yield for their carry opportunities, while remaining selective. We are more bullish tactically on real rates and inflation breakeven points, given the progress made in recent months.

Equity markets on both sides of the Atlantic rose almost like an arrow, by more than 8% in November, with the Nasdaq 100 even surpassing 11%. The steep drop in bond yields is, of course, what drove this exuberance, while the geopolitical environment did not get any worse. With no corporate releases to mull over, analysts have still not lowered their earnings forecasts, despite the gloomy economy. Such revisions are likely, however, and justify our cautious stance on risky assets compared to bonds. Surprisingly, we see that the equally weighted S&P 500 was almost unchanged and rose only because of seven Nasdaq stocks, called the magnificent 7”. For this reason, we are making no distinction between the upcoming performances of the European and US markets.

The euro began to give up ground to the dollar in late November, driven down by inflation that was lower than expected in the euro zone and a marked shift in the market’s expectations on ECB monetary policy in 2024. The markets are pricing an initial cut this spring. The euro’s weakness boosted the yen, which moved back below 160 in early December.

MACROECONOMIC VIEW

DISINFLATION BOOSTS MARKET EXPECTATIONS OF RATE CUTS

Head of Macroeconomic Research

and Strategy

OFI INVEST ASSET MANAGEMENT

The equity markets’ exuberant performance in November is due mostly to the pullback in bond yields, which fell by 40 to 60 basis points on 10-year maturities in the main countries. Two thirds of this was driven by the real-rate component, in connection with signs of economic slowdown in the US, and one third by the receding of inflation expectations, alongside disinflation.

US ECONOMIC LANDING IN SIGHT

Most US statistics (retail sales, business surveys and consumer confidence) point towards slower growth than in the third quarter, figures for which were revised to 5.2% QoQ annualised. This was corroborated by the Atlanta Fed model, one of the best for real-time forecasts and which forecasts US fourth-quarter growth of almost 1.2% QoQ annualised.

In the euro zone, November economic surveys showed a slight improvement compared to October. However, risks continue to point downward, as purchasing manager indices (PMIs) remain below the 50 threshold, i.e., in the zone of economic contraction.

Moreover, the Karlsruhe court’s ruling that unused Covid funds cannot be legally used for the energy transition is complicating negotiations within the German coalition on the 2024 budget, with downward risks to growth estimated at between 0.1 and 0.6 percentage point of GDP. Fiscal policy could therefore be more hawkish in Germany, and the aggregate euro zone budget deficit is expected to fall from 3.2% of GDP this year to 2.8% in 2024, according to European Commission forecasts. That said, things are very different from one country to another in Europe. Between nine and 13 of them are under threat of an excessive debt procedure next spring, including France.

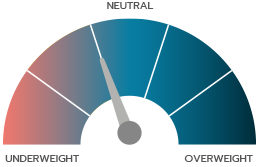

INFLATION IS SLOWING FASTER THAN EXPECTED

The good news continues on the inflation front, and reported figures were lower than expected. US total inflation in October pulled back to 3.2% year-on-year, and the slowing of the services and shelter components is more reassuring.

While this is an encouraging trend, core inflation is still too high, and that’s why Fed chairman Jerome Powell reiterated that it is still too early to speculate on when monetary policy might be eased. The markets are beginning to price in an initial key rate cut as early as May or even March. This looks too soon to us.

Disinflation is also continuing in the euro zone. Total inflation receded to 2.4% (from 2.9%), a low since son July 2021, and core inflation to 3.6% (from 4.2%). Basis effects on energy were caused mainly by the steep drop princes in November. However, good news came out of the services sector. In other words, the receding of energy prices is at last spreading to the other components. Moreover, there is more and more positive news, as producer prices continue to fall, driven by lower Chinese prices. This suggest that inflation should continue to moderate in food and manufactured goods in coming months.

The markets are beginning to ponder the possibility that the European Central Bank (ECB) will ease its monetary policy at the same time as the US Federal Reserve, or even before. However, as inflation is likely to slow more gradually in the euro zone than in the US and that it’s not crystal clear that wage momentum has peaked, and as the ECB’s reaction function is different from the Fed’s, this scenario looks unlikely, in our opinion. The ECB is expected to make no change to its monetary policy in December. While it is possible that it will lower its inflation forecasts for the next three years, it is unlikely to alter its language at this point.

INTEREST RATES

MARKETS REASSURED

Co-CIO, Mutual Funds

OFI INVEST ASSET MANAGEMENT

November featured some very good performances on the financial markets. While the equity rally is what investors and the media have noticed the most, the rally has been made possible by falling bond yields. Those falling yields, themselves, mean that the bond markets fared well. With 10-year German yields falling from 2.80% to 2.45% on the month, euro bond indices – both govies and corporate – returned almost 3.00%. High yield in particular performed very well in particular, and is up by almost 10% on the year to date.

WHATS DRIVING THESE PERFORMANCES?

The best way to understand the bond markets’ performance in November is to look at the macroeconomic outlook and central banks’ actions.

We said last month that the US economy would continue to surprise upward, with third-quarter growth ultimately revised to 5.2% and fourth-quarter estimates still strong. This good news for the US did not drive the markets any higher, as it suggested that the Fed could still tighten its monetary policy and, hence, raise its key rates even more. The Fed has kept its key rate at 5.25%/5.50% since July.

THANKS TO RECEDING INFLATION AND SLOWING US GROWTH

US data in November confirmed a gradual slowing in the economy but most of all a decline in inflation. US inflation came to 3.2% in October year-on-year, vs. 3.7% the previous month. Accordingly, the markets are now expecting the Fed to keep its rates stable for another few months before beginning to lower them in the second quarter of 2024 and to move its key rate back to 4.0% at yearend.

The well-worn saying “Bad news is good news” really makes sense here, as the economic slowdown is good news for the markets. The same goes for Europe, although GDP growth is already far weaker there than in the US. In short, the slowing in macroeconomic momentum has sent yields downward and driven strong bond market performances.

…BUT FOR HOW LONG?

We remain bullish on bond assets for the medium term. However, such performances are unlikely to be repeated in the shorter term. We share the market’s view on key rate cuts in 2024 by the Fed and the ECB, but believe that the markets may have gotten carried away in expecting these cuts to come rather soon. As for bond yields, the markets are now in line with our previous expectations. We are sticking to our long duration stance of above 2.50% on 10-year German bonds but believe that below this level neutrality is best. We therefore prefer carry assets and real rates to nominal rates, which provide some protection against a possible resurgence in inflation expectations.

CREDIT SPREADS AT A LOW ON THE YEAR

Bond yields have fallen, and credit spreads with them. As an indication, the iTraxx Xover barometer of the credit market’s health for issuers located at the border between investment grade and high yield has fallen below 370, a low on the year. It had been 100 bps higher early this year. Although November featured an outperformance by B rated issuers, we still prefer BB rated ones in the high yield universe. Within the bond asset class, we are still seeking out carry, with a great selectivity and still prefer money-market investments.

This is high yield’s year-to-date performance to 30 November 2023 (Bloomberg pan-European High Yield Total Return).

| BOND INDICES WITH COUPONS REINVESTED | NOVEMBER 2023 | YTD |

|---|---|---|

| JPM Emu | 2.96% | 3.33% |

| Bloomberg Barclays Euro Aggregate Corp | 2.30% | 5.31% |

| Bloomberg Barclays Pan European High Yield in euro | 3.02% | 9.66% |

Past performances are not a reliable indicator of future performances.

EQUITIES

YEAR-END 2023 RALLY...

...OR EARLY 2024 RALLY?

Co-CIO, Mutual Funds

OFI INVEST ASSET MANAGEMENT

Falling bond yields have triggered an across-the-board rally in risky assets. The “bad” economic news is piling up almost worldwide and show that economies are slowing down at a more or less moderate pace. The good news is that inflation expectations are also falling. In November, this drove bond yields down significantly, and that pushed the equity markets one notch higher.

This acceleration of the markets is a surprise. Yearend is generally a time for unwinding the riskiest positions, but this year the opposite has occurred. Surveys of investors show that they are still holding back substantial amounts of cash in funds, which shows that they are still being careful. Positive surprises on inflation, and the start of an easing of the geopolitical risk premium have forced investors to unwind these short positions.

So, naturally, growth stocks, which are traditionally long-duration, have fared well and outperformed. As a result, in the US, the heavily tech-weighted Nasdaq has made up the ground it gave up during the two previous months.

But November also saw a shift in trend that showed up in the rally of stocks and sectors that had been most overlooked throughout the year. The rebounds were surprisingly strong, whether in small and mid caps, which had been hit until now by their dependence on financing markets and their cyclical character; real-estate companies bogged down in renegotiating their balance sheet liabilities and valuations of assets; or, quite simply, manufacturers that disappointed during the latest reporting season. As an illustration, Unibail*, a property company, achieved the CAC 40’s top performance in November, at 24%. All these stocks have one thing in common – they are steeply discounted and far below their historical averages.

IS THIS START OF A REVERSION TO THE MEAN SUSTAINABLE?

Investors may want to believe that. Bond yields appear to have peaked and are now pulling back rapidly, as seen during the month on various yield curves.

And while central banks are sticking to highly conservative language, assumptions of initial rate cuts late in the first half of 2024 are beginning to be adopted by the consensus. For these assumptions to be wrong, inflation would have to once again be surprisingly high, and that does not at the moment seem to be in the march of history. Moreover, if economies were to become excessively sluggish, monetary easings would be greater and more rapid, so as to stimulate economic activity. Central banks have now restored room for stepping in.

WILL ALL THIS BE ENOUGH TO ACCELERATE GROWTH IN CORPORATE EARNINGS?

Hard to say, given that various economic releases are pointing to a soft landing, but a landing nonetheless. The consensus on 2024 earnings growth is still high, in our view. While downward risks on the equity markets may be contained by the implicit central bank put, the upside outlook still looks moderate, but rotation within the various markets may not be over!

The spike in the EuroStoxx 50 in November.

| EQUITY INDICES WITH NET DIVIDENDS REINVESTED, IN LOCAL CURRENCIES | NOVEMBER 2023 | YTD |

|---|---|---|

| CAC 40 | 6.23% | 15.48% |

| EuroStoxx | 8.00% | 14.83% |

| S&P 500 in dollars | 9.07% | 20.25% |

| MSCI AC World in dollars | 9.23% | 16.60% |

Past performances are not a reliable indicator of future performances.

Past performances are not a reliable indicator of future performances.

EMERGING MARKETS

EMERGING CURRENCIES: CONTEXT AND OPPORTUNITIES

Chief Executive Officer

SYNCICAP ASSET MANAGEMENT

The determination of the newly-elected Argentinian President to adopt the dollar as Argentina’s national currency is an opportunity to reflect on the topic of emerging currencies, with their intrinsic weaknesses, but also their strengths and the opportunities they offer.

The unexpected proposal of the new Argentine president, Javier Milei, to dollarise the economy looks quite bold for a country that has been an extreme caricature of both the weaknesses and strength of emerging market countries. Argentina is intrinsically and potentially a very rich country, but its governance has been disastrous for several decades, ridden with clientelism, corruption, and a lack of long-term vision. This has led to several debt defaults and debt restructuring plans. This has naturally fed a constant flight of capital out of the peso and mainly into the dollar, causing one of the world’s highest inflation rates, at more than 140% year-on-year recently, and the currency has collapsed.

Against this backdrop, the announced dollarisation of the Argentine economy looks especially ambitious and is worth keeping a close eye on. It is likely to open up a path for other emerging market countries facing similar, albeit less exacerbated (for the moment), structural problems of capital flight and lack of intrinsic confidence in currencies.

The GBI-EM index of sovereign bonds in emerging market countries in local currencies takes in 20 countries and is relatively well balanced geographically between Asia (35%), Latin America (29%), Eastern Europe (27%) and South Africa (8%). The rest of the world – the Middle East including Turkey – is marginal. The main countries include Brazil, Mexico, Indonesia, Malaysia and Poland, with weightings of between 9% and 10%.

EMERGING CURRENCIES LOOK UNDERVALUED

Trends in these currencies vs. the dollar and the euro are an essential component in the performance of this asset class, which is currently yielding almost 6.50% for government debt and with an overall rating of BBB/ BBB+. On the whole, emerging market currencies look rather undervalued. According to a Bloomberg analysis – which uses the “Big Mac” index to try to assess or estimate currencies’ value in purchasing power parity terms - all emerging market currencies in the aforementioned index are undervalued. The least expensive, based on this indicator, are the South African rand and the Turkish lira, with theoretical discounts of about 60%.

The Malaysian ringgit and Indonesian rupee also look attractive, at discounts of almost 50%. The “most expensive” ones are the Brazilian real and the Colombian peso, at discounts of 10% and 20%, respectively.

On the whole, emerging currencies have been penalised in recent years by inflation, which hit emerging markets before Western countries and, above all, the dollar’s strength. But the trend has reversed itself in recent months, and they are once again outperforming. This rally may gather strength, based on the very safe assumption of a pause in the US monetary tightening cycle or even the start of monetary easing in mid-2024. Historically, phases of relative weakness in the dollar have been rather favourable to emerging currencies. Moreover, the central banks of emerging market countries have, on the whole, managed the resurgence in inflation rather well, raising key rates rather early, before Western central banks did, so much so that inflation has fallen considerably and real rates are once again in positive territory.

GAINS IN EMERGING CURRENCIES WOULD BOOST BOND PERFORMANCES

In short, the currency component is key to the performances of sovereign bonds issued in national currencies. Their potential yield could be joined by a recovery in emerging currencies. This asset class looks like a good diversification in an international bond portfolio.

GBI-EM index performance for sovereign bonds in emerging market countries in local currencies.

Past performances are not a reliable indicator of future performances.

Syncicap AM is a portfolio management company owned by Ofi Invest (66%) and Degroof Petercam Asset Management (34%), licensed on 4 October 2021 by the Hong Kong Securities and Futures Commission. Syncicap AM specialises in emerging markets and provides a foothold in Asia, from Hong Kong.

Document completed on 06/12/2023

Carry: a strategy that consists in holding bonds in a portfolio, possibly even till maturity, in order to tap into their yields.

Core inflation: inflation ex energy and ex food.

Duration: weighted average life of a bond or bond portfolio expressed in years.

Inflation: loss of purchasing power of money which results in a general and lasting increase in prices.

Investment Grade / High Yield credit: Investment Grade bonds refer to bonds issued by borrowers that have been rated highest by the rating agencies. Their ratings vary from AAA to BBB- under the rating systems applied by Standard & Poor’s and Fitch. Speculative High Yield bonds have lower credit ratings (from BB+ to D, according to Standard & Poor’s and Fitch) than Investment Grade bonds as their issuers are in poorer financial health based on research from the rating agencies. They are therefore regarded as riskier by the rating agencies and, accordingly, offer higher yields.

Volatility: corresponds to the calculation of the amplitudes of variations in the price of a financial asset. The higher the volatility, the riskier the investment will be considered.

This promotional document contains information and quantified data that Ofi Invest Asset Management considers to be well-founded or accurate on the day on which they were produced. No guarantee is offered regarding the accuracy of information from public sources. The analyses presented are based on the assumptions and expectations of Ofi Invest Asset Management at the time of the writing of this document. It is possible that such assumptions and expectations may not be validated on the markets. They do not constitute a commitment to performance and are subject to change. This promotional document offers no assurance that the products or services presented and managed by Ofi Invest Asset Management will be suited to the investor’s financial standing, risk profile, experience or objectives, and Ofi Invest Asset Management makes no recommendation, advice, or offer to buy the financial products mentioned. Ofi Invest Asset Management may not be held liable for any damage or losses resulting from use of all or part of the items contained in this promotional document. Before investing in a mutual fund, all investors are strongly urged, without basing themselves exclusively on the information provided in this promotional document, to review their personal situation and the advantages and risks incurred, in order to determine the amount that is reasonable to invest. Photos: Shutterstock.com/Ofi Invest. FA23/0227/05062024.