A WORD ON

ASIA EX CHINA

Asia isn’t just China

Chief Executive Officer

SYNCICAP AM

Japanese/Asia equity manager

OFI INVEST ASSET MANAGEMENT

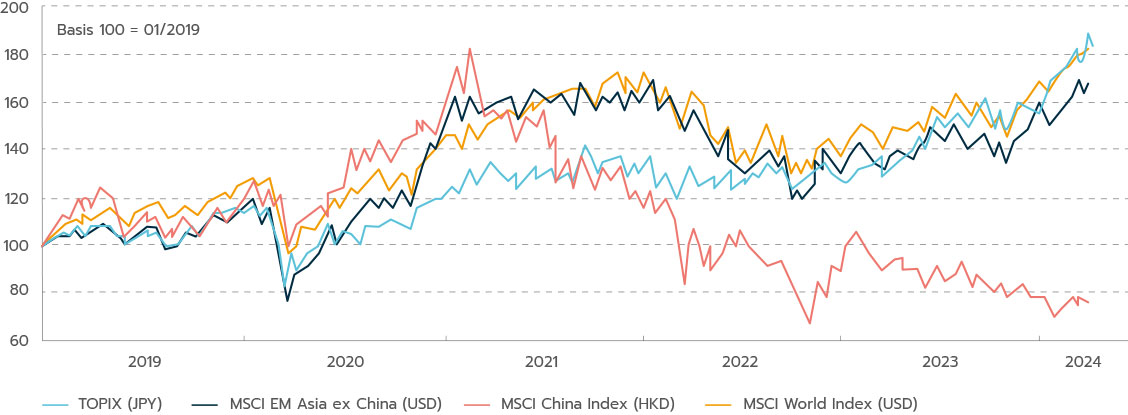

Almost 2 billion people live in Asia ex China, or one quarter of the world’s population. “This is an economically attractive zone that complements China, with a heavy population and highly diverse financial markets having a cumulative market cap of 8,700 billion dollar and 13,000 listed companies. Within this zone, come countries are at a highly advanced stage of development, such as Korea and Taiwan, while others, such as India, are still developing. In addition to purely geographical aspect, the region is above all well placed to benefit from the advent of three structural growth themes”, explains Jean-Marie Mercadal, Chief Executive Officer of Syncicap AM.

Asian ex China equities offer an opportunity for exposure to the momentum of three structural growth themes, which are still at very early stages of development:

1 - The theme of artificial intelligence (AI). It seems rather clear that AI is just getting started. Many studies have found that AI will allow those countries that are the furthest along in AI to boost their potential growth and productivity significantly. In short, there are big stakes in AI. According to a Goldman Sachs study, annual investments in AI are likely to rise sharply in the coming years, amounting to almost 200 billion dollars in 2025. In the longer term, AI-related investments could reach 2.5% to 4.0% of GDP in the US and 1.5% to 2.5% in the other largest countries. Asia has a few companies that are well placed in this sector, including two global leaders that are must-haves. One of these is TSMC*, the Taiwanese semiconductor maker, which enjoys a big lead in advanced nodes and latest-generation connectors, with 80% to 90% market share. Another one is the Korean company Hynix*, which specialises in highbandwidth memories, used, among other things, in AI graphics. Hynix currently has market share of about 50%. More generally, the technology sector, broadly defined, accounts for almost 40% of the investment universe of this zone.

2 - The theme of the boom in household consumption, with the emergence of a middle class in heavily populated countries like India, Indonesia and Vietnam. This is a classic trend in developing countries. Higher income levels raise living standards considerably for a portion of the population, giving them access to heretofore inaccessible consumer goods and leisure. This is good news for many companies that are managing to establish franchises or brands, thus becoming leaders.

3 - The theme of “bypassing China”, also called the “China +1 strategy”. China has become controversial in recent years. The Covid crisis brought to light Western economies’ overdependence on China, the “world’s factory floor”. Meanwhile China’s more top-down governance, with, moreover a conciliatory attitude towards Russia, have taken Western countries aback. The US has sanctioned many Chinese companies. All this is pushing both Western and Chinese companies to invest in the rest of Asia. Direct investment is accordingly flowing into neighbouring countries, such as India, Vietnam and Indonesia. This is very good news for infrastructure companies.

The Japanese equity market is currently undergoing significant structural shifts. One of these is in inflation, which is moving away from two decades of near-zero or even negative levels. This sustained rebound of inflation points to a fundamental shift in Japan’s economic environment, which could give rise to new investment opportunities and new growth sectors.

Japanese equities are trading at valuations that we feel are favourable. The current reform of the Tokyo Stock Exchange (TSE) could be particularly beneficial as it aims to promote better understanding of undervalued shares. Moreover, the changes being made to the Nippon Individual Savings Account (NISA) are encouraging Japanese individuals to invest in equities.

Meanwhile, amidst the current geopolitical tensions between China and the US, we have seen renewed interest from foreign investors for Japanese equities. This interest is being driven, among other things, by Japanese companies’ earnings growth, which we expect to be longlasting, driven by higher prices.

One potential obstacle that the Japanese market may face is the appreciation of the yen, in particular vs. a weakening dollar, in the event of a global economic slowdown, alongside falling interest rates. Such exchange-rate fluctuations could have a significant impact on exportintensive sectors and on broad market sentiment.

So, while there are positive signs on the Japanese equity market, risks arising from shifts in the yen and broader global economic issues call for a conservative and strategic approach. Our objective is still to identify resilient sectors and companies endowed with solid fundamentals and sustainable practices that align with long-term growth trends.

Jean-François Chambon, Japanese/Asia equity manager, Ofi Invest AM: “Our investment process in Japanese equities begins with a top-down approach that researches long-term thematic trends. This strategic vision helps us identify the fundamental themes and economic conditions likely to influence various market sectors before moving on to a detailed analysis for selecting those companies that offer potential growth and that align with our investment themes”.

Jean-Marie MERCADAL is the Chief Executive Officer of Syncicap AM, an investment company specialising in emerging markets, a Hong Kong-based joint venture set up in 2021 by Ofi Invest and DPAM.

Jean-François CHAMBON is a manager of Japanese and Asian equities at Ofi Invest Asset Management. He has been a recognised specialist in this asset class since 2005 after having managed European equities.

Completed on 18 April 2024

* Company citings are for information purposes only. They are neither an offer to sell, nor a solicitation to buy, securities.

This promotional document was produced by Ofi Invest Asset Management, a portfolio management company (APE code: 6630Z) governed by French law and certified by the French Financial Markets Authority (AMF) under number GP 92-12 – FR 51384940342, a société anonyme à conseil d’administration [joint-stock company with a board of directors] with authorised capital of 71,957,490 euros, whose registered office is located at 22, rue Vernier 75017 Paris, France, and which has been entered into the Paris Registry of Trade and Companies under number RCS 384 940 342. This promotional document contains informational items and figures that Ofi Invest Asset Management regards as well-founded or accurate on the day on which they were researched. No guarantee is offered regarding information or figures from public sources. The analyses presented herein are based on the assumptions and expectations of Ofi Invest Asset Management at the time this document was written. It is possible that some or all of these assumptions and expectations may not be borne out in market performances. They do not constitute a commitment to performance and are subject to change. This promotional document offers no assurance as to the suitability of products or services presented and managed by Ofi Invest Asset Management regarding the financial situation, the investor’s risk profile, experience or objectives and constitutes neither a recommendation, nor advice, nor an offer to buy the financial products mentioned. Ofi Invest Asset Management declines any liability for any damages or losses resulting from the use of all or part of the information contained herein. Before investing in a fund, all investors are strongly urged to review their personal situation and the benefits and risks of investing in order to determine the amount that is reasonable to invest, but without basing themselves exclusively on the information provided in this promotional document. An investment’s market value may fluctuate either upward or downward and may vary with changes in interest rates. No guarantee is offered that the products and services presented herein will achieve their investment objectives, which depend on market risks and the state of the economy. Past performances are not a reliable indicator of future performances. The Key Investor Information Document (KIID) and the prospectus are offered to subscribers prior to investing and must be given to them upon subscription. The KIID, prospectus and latest financial statements are available to the public upon request from Ofi Invest Asset Management. FA24/0122/18042025